The Dutch P&C Insurance Market hit hard by socio-economic developments

Socio-economic factors outweigh technological developments

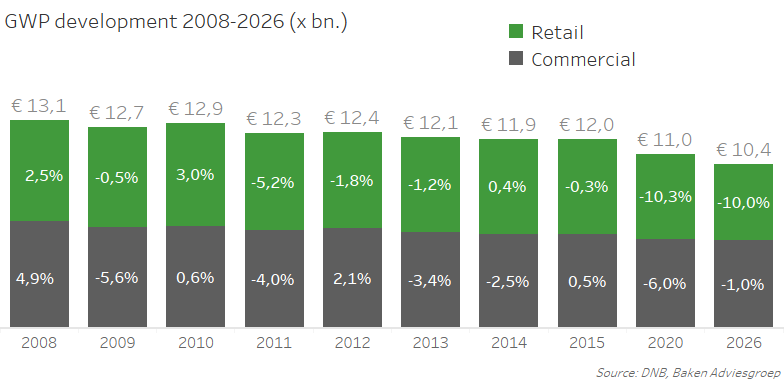

Revenue on the Dutch P&C insurance market will decrease substantially over the next decade. The retail motor insurance market in particular will be hit extremely hard. Contrary to common perception, the market contraction will not be caused by technological disruption but primarily by socio-economic factors. Furthermore, profitability will remain extremely low due to competitive pressure. Substantial cost reduction will be necessary to remain competitive. Only fundamental business model innovation will achieve this objective. These are the main conclusions of the report De schademarkt in 2026 by Baken Adviesgroep and Trend-Rx, published in May 2017.

Based on various scenarios, Baken and Trend-Rx quantified all major trends and developments in the Dutch P&C insurance industry. Dutch P&C GWP will decrease by 13 percent until 2026. The retail market is expected to show a 19 percent decrease in volume. The commercial market will be slightly better off with a volume decrease of 9 percent (excluding credit Insurance, 12 percent) . In particular, the private car segment will be hit extremely hard with a GWP decrease of 31 percent.

Baken and Trend-Rx do not expect market disruption through substantial technological innovation. Important technological developments such as self-driving cars are not expected to have a significant GWP impact before 2030. Nonetheless, the industry will be faced with substantial GWP declines. These are primarily driven by socio-economic changes such as relative impoverishment, an aging population and urbanisation. Moderate economic growth over the next 10 years will lead to relative impoverishment and lower value of possessions, especially amongst younger generations. For example, the number of new car sales is expected to fall by more than a third in this period. New car sales are under pressure not only because of lower incomes, but also due to the dying of the elderly, car-buying, generations and continued urbanisation. The decline of new car sales will extend the average age of the Dutch car fleet by more than two years, resulting in a shift from all-risk policies to substantially cheaper liability products. The current 2-1 all-risk versus liability only ratio will fully reverse. Despite a growing number of car policies overall GWP will therefore fall by 31% in the private motor segment until 2026.

Profitability will remain very low during this period due to continued strong market rivalry. Premiums remain under pressure due to sustained heavy competition, the result of a large number of players of similar size offering similar products, a market wide irrational wish to operate in all segments and a lack of market leadership. Although the combined ratio is currently improving marginally, the overall market combined ratio is expected to remain too high for sustainable profitability. Almost every P&C market segment in both retail and commercial markets will suffer from comparable socio-economic and competitive developments as the motor insurance segment.

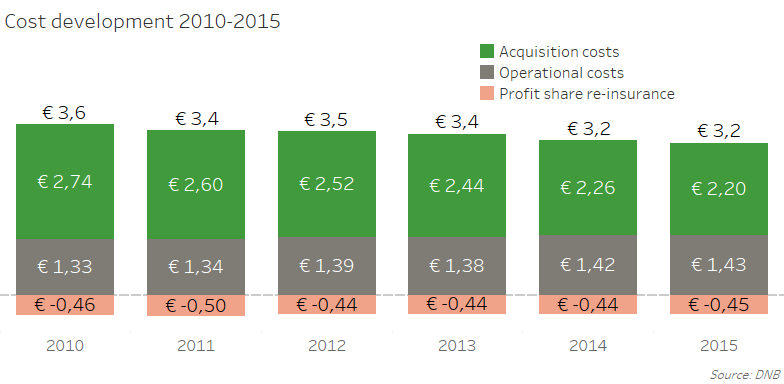

Simultaneously, the cost base of insurers will cave. The much talked about technological breakthroughs will be largely applied to the administrative processes of insurance companies. On the B2C market, insurance companies will have to reduce costs by € 630 million over the next 10 years. On the B2B market, cost reductions of € 365 million are required to remain competitive. This will prove to be an extremely difficult challenge given the limited cost control capabilities insurance companies have shown so far this decade.

Although overall costs have decreased, operational costs (staff, amortisation and depreciation) have actually increased during this decade. Only by reducing out of pocket acquisition costs have insurance companies managed to control their expenditure and remain in line with GWP developments. To achieve substantial cost reduction, extensive business model innovation will be necessary. The current innovation focus on marginal gains and short term solutions is insufficient to achieve the objective of a € 1 billion cost reduction. Insurance companies are forced to develop new business models while simultaneously preparing a smooth phasing out of their current business models.

Arno Onink of Trend-Rx: “Revenue and cost developments are major challenges, especially since we do not expect new market development to create substantial premium volumes. The sector will be faced with substantial technological breakthroughs around 2030 and will need to anticipate a soft landing of its current business model.”

Daniel Koudijs of Baken Adviesgroep: “The current focus on micro-innovation in response to market developments diverts attention from the challenges in strategic areas. The industry must find a balance between the focus on the issues of today and the distant dot on the horizon.”

This research is a cooperation between Trend-Rx and Baken Adviesgroep. The report quantifies the Dutch P&C market until 2026. Trend-Rx is a data-driven, evidence-based trend consultancy. Baken Adviesgroep is a market research agency specialized in delivering tailor made data and insurance reports. For inquiries please contact:

Trend-Rx

Arno Onink

arno.onink@trend-rx.nl

+31 6 1394 3646

trend-rx.nl/en

Baken Adviesgroep

Daniel Koudijs

dkoudijs@bakenaviesgroep.nl

+ 31 6 1475 3741

www.bakenadviesgroep.nl/en